Ask the right questions to know where your cash flow is

If you’re in healthcare leadership (meaning you’re an owner or operator), it's critical you know the right questions to ask your manager about the AR (accounts receivable) and RCM (revenue cycle management). Otherwise you will not have answers to your most pressing issue: cash flow.

And …. If you’re a manager, you must be able to intelligently summarize healthcare AR for executives and leadership. It’s a critical skill.

The wrong way

Most AR review meetings do it the wrong way: printouts (or Excel pivot tables) of aging buckets, and individual balances. And then the meeting gets sidetracked by digging in to the weeds. Usually, one or two big dollar claims that are close to timely filing. The diversion begins with “What’s going on with Jon Doe? Why does he have $50k over 90 days?”

The right way to review your AR

Here’s how to ask the right questions and answer them intelligently. This framework keeps you focused on the big picture.

1. How does this month compare with last month? And the month before?

-

-

- Meaning: did the total AR go up or down compared with prior months? Why?

- Was the change caused by a particular facility, payer? Or some other known factor?

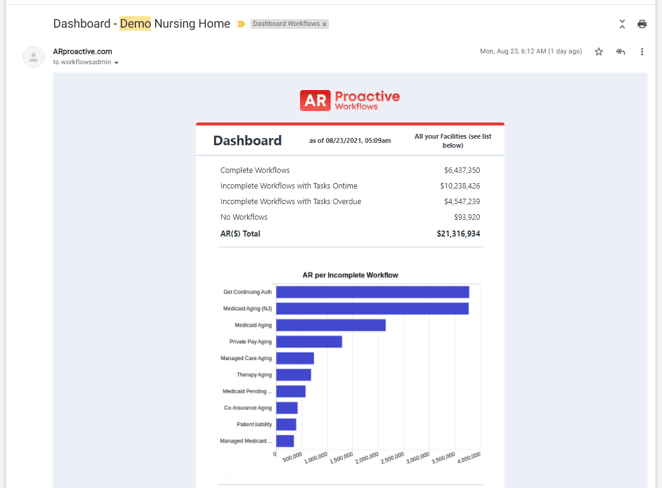

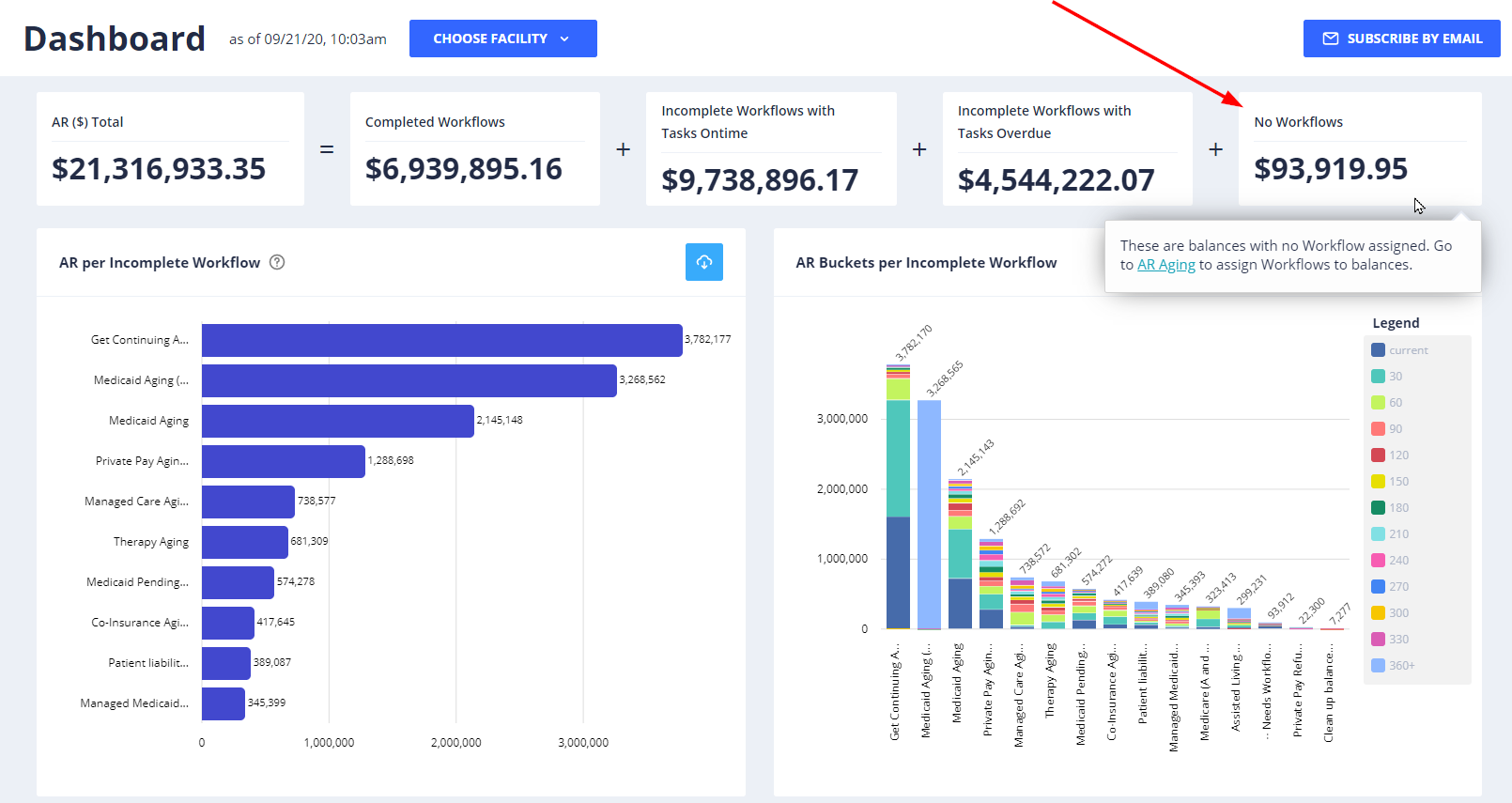

- As a manager you must take monthly snapshots of your AR Dashboard (or have it sent to your email inbox), so that you explain trends and support it with data.

2. Are there any AR dollars that are not being worked?

-

-

- Meaning, is every dollar on the AR accounted for, so that we know which staff member is responsible for it? Or we know, it's too new (or old) to bother working it.

- In our AR Workflow Automation software, unworked balances are identified by the label “Needs Workflow”. You can drill down from the Dashboard to see these amounts. And then configure Workflow Trigger rules so that the balances get worked. And converted to cash.

3. What are the biggest buckets of AR?

-

-

- Meaning, look at the biggest bar on every chart and be able to explain why it's bigger than the other bars.

- Make sure your team can slice AR in a few directions, like which are the biggest buckets by:

-

- Age

- Facility

- Payer

- Staff member

4. How are staff performing?

-

-

- Look at the number of Tasks completed per week and per month. Make sure staff are consistently completing Tasks each week. It Task completion is erratic, ask: "Is there monthly cycle why Jane Biller sometimes does a lot of Tasks and then zero the next week?"

- Is any staff member overloaded with AR (dollars) or Task (count)? If s/he cannot keep up, then re-assign those Tasks to others on the team.

5. Which payers have the most AR?

-

-

- Your Top 4 payers can account for 25-50% of your AR. Meaning, must know the names of those payers, because it's low-hanging-dollars. The more expert your team is on those payers, the faster your cash flow will be.

- Have there been any changes in the Top 10 Payers from this month to previous month? This question is a like an early warning system to tell you if there's anything broken with your RCM process. Because if everything is working, the Top 10 Payers should about constant.

What you can do next

During the next AR review meeting, print this page (or bring it on screen). And then ask the 5 questions above...

Listen closely to the answers. If they don't make sense, dig in to help your team get clarity and take action.

Repeat for 4 months.

I guarantee that your cash flow will improve.

Let me know how it goes! Keep up the good work and be good,

Rich Handler

CEO, AR Proactive